The Collapse Of The American Economy

The next recession (or more likely, depression) will be the straw that breaks the camel's back...

Since our next article will be a big milestone (our 100th article), I thought long and hard about what I wanted our 99th to be about. I knew whatever topic I decided on had to be a very important one.

I decided to write about the issue that virtually everyone is thinking about to some extent, whether the thought just sort of dwells in the back of one's mind, or it haunts ones thoughts minute by minute, everyone who's paying attention wonders at least from time to time... is the American economy collapsing?

The answer, unfortunately, is.... yes, it is.

We've written before about the coming collapse of the American empire, and despite popular opinion, the real collapse will arise out of bad economic and monetary policy, not civil war as Tim Pool frequently masturbates to. As Caleb Jones has correctly pointed out on in his videos and blog posts many times, Americans (especially men who, not to sound sexist, are usually the ones who fight wars) are way too fat, drug-addicted, out-of-shape, low-testosterone, and beta to actually pick up a gun and shoot other Americans.

As we've predicted (probably correctly) the collapse of the United States will come from a combination of the U.S. dollar being devalued into oblivion (hyperinflation), unchecked corporatism and American politicians climbing into bed with multinational corporations, and socialism (both populist and corporate).

Combine the above with AI replacing large sectors of the economy, a welfare-state driven greatly by modern feminism, and a generation of men in their 20s and 30s who are still virgins, and you have yourself one hell of a dysfunctional, pissed-off populous. In fact, they're so pissed off that many of the men who once produced greatly for society - building up our infrastructure, climbing corporate ladders, starting small businesses, and problem-solving - are completely giving up. Instead of fueling and growing the U.S. economy, many of them have turned to sitting on their asses and smoking reefer all day, playing video games, and when the clock strikes 5PM, dumping copious amounts of booze down their throats (if they had the willpower not to start that the very second they woke up). And what happens when a government prints money, and the men who were tasked with producing and growing an economy all simultaneously decide to stop? Well the laws of economics are pretty clear - you get inflation - and not even the kind of inflation the Fed pretends is good. No! You get economy-destroying inflation. The kind of inflation that causes real, serious pain in society. The kind of inflation that impoverishes and then destroys the middle class. The kind of inflation that topples down nations.

Of course, there's plenty more fueling the inflation problem in this country. Most of the same third and fourth wave feminist women who love the welfare state we spoke of earlier, are (obviously) the same women who were begging the government on social media in 2020 and 2021 to give them free money in the form of stimmy checks. Most of us would probably have a bit more compassion for them if the government had forced them to stop working, but of course that's not what happened. Most of these women (and some very weak men)

wanted the government to shut down the economy so they could stop working. Then, when they got what they wanted,

they got mad when the government gave money to the small business owners who

did not want the government to forcefully shut down their businesses, and many of them are still complaining about it to this day (including the current POTUS, who personally signed into law the third round of PPP and EIDL loans in 2021, amounting to over twenty-two billion dollars)

$760 billion in PPP loans were forgiven.

— The White House (@WhiteHouse) June 30, 2023

That’s $360 billion more than this Administration’s student debt relief program.

And, several Republican members of Congress who opposed student debt relief benefited from those PPP loans.

And as mentally challenged as this Amy Nixon woman below sounds, at least she seems to be able to admit that government spending does in fact cause inflation, which is one step ahead of most of the left these days. She seems to have forgotten that stimulus checks were also passed in these same spending bills, but stipulating that in the tweet would've rendered her entire argument meaningless.

If you took out a PPP loan and had it forgiven, and now are tweeting about how student loan cancellation will be inflationary…

— Amy Nixon (@texasrunnerDFW) August 23, 2022

Twitter is gonna find you and call you out, so maybe don’t do that #studentloanforgiveness #PPPLoans

And below is a great example of one of these weak men we spoke of earlier, who almost certainly advocated for lockdown and the forced-shuttering of small businesses, and then got mad about that we gave them PPP money. What the fuck is this shit!?? No! We should forcefully close their businesses and let their families starve! exclaims Wes Morris of the liberal hivemind.

I will die on the hill that most people against student debt forgiveness also took out a PPP loan that was forgiven

— Wes Morris (@WesMorris10) June 19, 2024

I also couldn't help but to own one of these morons on Twitter, who are still, years later, complaining that the businesses they wanted to forcefully close were given money to stay afloat in the meantime, and the money he voluntarily accepted for a student loan long before 2020 wasn't paid for him by other people who didn't go to college. The entitlements of these people never ceases to amaze.

Because YOUR SIDE of the political isle wanted these businesses shut down in the first place. The actual business owners DIDN'T. YOUR SIDE also went to college, voluntarily took out a loan that you knew you'd have to pay back, and now you're upset about it. Please grow a brain.

— Turd Ferguson of EndingPolitics.com (@Ending_Politics) July 31, 2024

Anyhoo, even the COVID-19 Scamdemic didn't single-handedly cause inflation. Over half a decade before the scamdemic, even the biggest of the Central Bank cucks were able to admit that the U.S. dollar had already lost 96.4% of its purchasing power due to the Fed's loose monetary policy. Not a great look considering the Fed was only (supposedly) created in the first place to stabilize prices. "Stabilizing prices," in the eyes of the government, is devaluing its own currency into oblivion and impoverishing its citizens. That's the U.S. government for you!

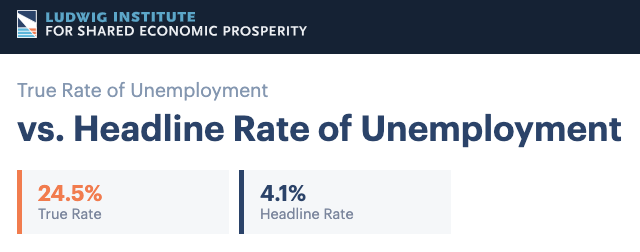

Those of us who follow the economy closely also know that the government has been lying about the unemployment rate for decades. The Ludwig Institute For Shared Economic Prosperity tracks the true unemployment rate against the headline unemployment rate, and the stats currently sit above 24% compared to the government's BS headline of 4%.

On top of all the other bad news, Zerohedge reported last week that the UMich Consumer Sentiment Index hit its lowest level since December of 2022 (in case you've forgotten, that was when the establishmentarians had to change the definition of a recession, since we had objectively seen two consecutive quarters of real negative GDP growth, which was the textbook definition of "recession" for centuries, up until that very moment).

And Zerohedge had already published even worse news just three weeks earlier, when they accurately pointed out that the Sahm Rule had been triggered. The Sahm Rule almost always indicates a recession is imminent, or is already occurring.

And then there's the big pink elephant in the room that no one wants to address: if the economy is actually firing on all cylinders, then why aren't banks lending? If we're headed for this (highly mythical) period of endless economic prosperity, ushered in by the brilliant economic minds of President Joseph R. Biden and Fed Chair Jerome Powell, then why are the banks so afraid to loan money to people? Bankrate.com reported all the way back in Q1 that half of Americans that applied for loans over the past year were turned down, according to a survey they'd conducted.

During an interview with Michelle Makori at Kitco News a few days ago, macroeconomics expert George Gammon made it pretty clear that the banking cartel knows a giant economic collapse is on the horizon, the banking crisis has just begun, and that there is significant pain about to be felt by all of us.

And lastly, there's the most powerful recession indicator of all: the yield curve. We've just experienced the longest yield curve inversion of all time, over two years, and we're about to un-invert. The un-inversion of the yield curve will almost definitely signal the beginning of a long, painful recession, or perhaps even a second Great Depression - the likes of which we've never seen before - and could be significantly more painful than the 1930s.

It goes without saying that the coming economic collapse will usher in a period of unbearable pain and hardship for many. Many will lose their homes, many will see their asset values plummet, many will struggle to afford food - and the Fed is damn near out of tricks. The can-kicking has gone on for so long that there's not much left that could be done to save the economy from complete collapse. This zombie economy has been on life support for so long that it looks like one of the living-dead that's been endlessly experimented on to try to find a cure for the T-virus in the Resident Evil: Extinction movie. It may not be a bad idea to stock up on your emergency food supply - because we're set for one cold economic winter.