Emma Vigeland Understands Inflation Even Less Than Sam Seder

If it's even possible, Emma Vigeland and her Thursday afternoon Majority Report cohosts seem to understand inflation even less than Sam Seder.

In a shockingly exemplary display of the Dunning Kruger Effect last week, Emma Vigeland and her fellow Thursday afternoon cohosts on The Majority Report with Sam Seder attempted to discuss their (lack of) understanding of what's causing the current bout of inflation we've seen over the last two and a half years. And if it's even possible, she seems to have an even poorer understanding of the way the economy works than her boss.

We've written before about Sam Seder's ignorance on inflation, and also about the current inflation conspiracy theories being shared around far-left progressive circles, but on last Thursday's episode of The Majority Report with Sam Seder, we heard the single-most ridiculous claims yet in regards to what the left believes about inflation and the economy.

Grab a hot cup of coffee and sit back in your recliner. This is going to be a long (but fun) one.

Emma Vigeland's shocking ignorance of inflation, as well as how the broader economy works, is bad enough, but adding two other economically-ignorant stooges into the equation makes it even more entertaining, yet time-consuming, to debunk all the ridiculous and provably false claims they made in only a 12 minute timespan. So, we'll start at the beginning, and try to work our way through this video chronologically, as best we can.

The video (which can as of the time of this writing still be found on The Majority Report with Sam Seder YouTube channel so make sure to go watch it before their staff takes it down and flushes down the Orwellian memory hole) begins with a man calling their show, and asking them if they believe that "corporate profits" are driving the current inflationary period. Matt Binder (who's quite possibly the most economically-ill-informed person on their show) nods his head in absolute certainty that a large corporate conspiracy theory is what's been raping the American people's pocketbooks for the past couple years, while the voice-off-camera (whose name is Matt Lech, aka "The Disembodied Voice" according to Sitch & Adam) says so eloquently "pretty much, yeah." He also claimed that "COVID" and "war-related shocks to the supply chain" were to also to blame, as if an inanimate virus had any authority on monetary policy in the United States at all, or the big-bad-meanie Vladimir Putin, half the world away. "Even Wall Street Journal writers are coming around to it, despite denying it for awhile," he says, as if that was evidence of anything at all (and we're not entirely sure what he's talking about anyway, as the Wall Street Journal recently published an article claiming the opposite). He also claims "there's new reports about an algorithm Amazon is using to raise prices," which is of course just another anecdote that, once again, doesn't actually prove anything anyway. Then he claims "it's definitely not UAW workers." Again, we're not quite sure what he's talking about - we're not even sure if any serious economist in the world has claimed UAW workers are causing inflation. Vigeland then cuts in and claims that it's not just "corporate profits," but "price-gouging" (which is illegal in many states, so even if this nonsensical claim was true, we're not sure how any company would actually be able to get away with it) that's causing inflation specifically. All of these claims are quite easily debunked through a simple Google search (if not already through an elementary-level understanding of basic economics), but to be as thorough as possible, we'll take them all one at a time.

To begin, we'll debunk the nonsensical claim that somehow Vladimir Putin and his war on Ukraine has any effect whatsoever on inflation in the United States, because it's the quickest and easiest to debunk, and quite possibly even more nonsensical than the notion that corporate billionaire meanies are causing the inflation. Vigeland claims it was primarily supply chains of wheat that were disrupted by the way that contributed to Russia's share of inflation. This is probably the most easily falsifiable sentiment mentioned in the entire segment. First of all, America has not only never been a major importer of Russian or Ukrainian grain, but we can't even find evidence anywhere on the internet that America has ever imported any grain ever from Russian and Ukraine. Not only that, but the vast majority of America's wheat supply is made domestically, right in Kansas, but the wheat that is imported comes primarily from Canada and Mexico. But to debunk this claim even further even the small amount of grain we import from other countries also aren't importers of Russian or Ukrainian wheat. As proof, we've attached an infographic from Al-Jazeera below to show specifically what countries import most of Russia and Ukraine's wheat.

That said, even if all this weren't true, the entire food supply of the USA only makes up about 14% of the CPI anyway, and wheat even less so.

Even though it wasn't mentioned during this segment, we'll debunk another Eastern European war inflation myth, since we're already on the subject, and that's the price of gas. This was another nonsensical claim spouted in particular by President Biden (though not so much by the mainstream media; even those talking heads were pretty skeptical of this claim) in June 2022. Before we go on, it's noteworthy that gas prices were already well on the rise before Putin invaded Ukraine.

Anyhoo, despite gas accounting for only about 4% of the entire CPI anyway (as Pew Research correctly points out), obviously not all gas is made from Russian-imported oil, and more obviously, not all oil is made into gas. In fact, only about 45% of your typical barrel of oil is made into gas, and only 8% of America's oil was imported from Russia pre-invasion. Russia's actual calculable impact on the CPI is so minuscule that it's almost not even worth trying to estimate, and we're no mathematicians, but we'll do our best to try to calculate the actual impact on the CPI. .45 (45% of a barrel of oil converted to gas) times .08 (8 percent of all oil pre-invasion imported from Russia) equals .036 (about 3.6% of actual gasoline in the United States), times .04 (4% of the CPI) equals - by our estimation - about .14% of the entire CPI is represented by consumer gas that was converted from Russian oil pre-invasion. By our estimates, losing Russia's share of America's gas barely had an effect at all on the actual inflation rate.

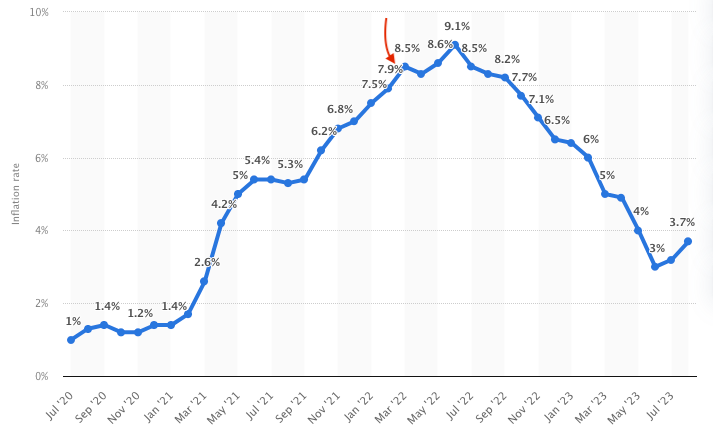

And if that wasn't enough, we really should also mention a pretty convincing piece of evidence the caller actually presented during the segment. Indeed, the CPI data trends prove beyond any reasonable doubt that the affect the Eastern European war had on American inflation was virtually nil. The caller's logic is correct. If the war had any significant effect on inflation whatsoever, the data would show it - we'd see a significant jump in inflation immediately after the invasion began. Unfortunately for Vigeland and the voice-off-camera's theory, the upward trend in inflation remained steady after the invasion began, and all the way through its peak in the summer of 2022. And in fact, there was actually a brief but measurable deceleration in inflation shortly after the war in Eastern Europe began, as pictured below, compliments of Statista.org.

Now that we've debunked that myth in its entirety, back to the segment in question. Vigeland then claimed that "CEO bonuses" (CEOs of corporations which we don't even think

she knows, as she didn't even name any specifics) is evidence of "price-gouging" (the activity that's illegal in many states, that somehow these unnamed corporations are seemingly getting away with). This is such a ridiculous claim that we're not even sure if it's worth debunking, but we will just for the sake of being thorough. First of all, CEOs are bonused every single year, in a variety of ways. But to completely debunk Vigeland's claim, in 2022, when inflation was peaking,

CEO pay actually declined, even according to the

left-leaning Economic Policy Institute. Emma, if you're reading this, you really need to check your facts before you go spewing patently false information on your show. This information is easily findable through a simple Google search.

Continuing down our checklist, we now come to the voice-off-camera's Axios article, which in and of itself offers literally no more proof than anything else they've claimed so far into this video, but let's debunk the one piece of actual evidence in the entire article anyway, from Lael Brainard, from whom the exact same quote Matt Lech read from his Axios article, we've actually already debunked in our last article about Sam Seder's ignorance on inflation. But to make things more interesting, the caller actually cited the exact same evidence we did in our last article to prove Lael Brainard's quote false. We turn again (along with the caller in the segment) to the left-leaning Economic Policy Institute, whose report from late-2021 seems to be the only piece of actual data-driven evidence the left can ever refer to when pressed about their conspiratorial claims of corporate profits driving inflation (on a brief side note, even in your run-of-the-mill journalistic pieces we've read on the issue, there really aren't very many that claim "price-gouging" is causing the inflation - most that we've seen quote the EPI study directly and say "corporate profits" and not "price gouging" - the difference we'll touch on yet again in this article, for the third or fourth time in the past year).

Anyway, the voice-off-camera (pardon us for using that term, we're big fans of the punk rock band Rise Against, and "Voices Off Camera" was by far the best track off their second studio album, Revolutions Per Minute, and had an awesome electric guitar line, hence us thoroughly enjoying using the term) cites one small passage in an article titled "Once a fringe theory, "greedflation" gets its due" by Emily Peck. In it, the voice-off-camera mentions the same Lael Brainard quote Sam Seder once cited, which we proved false a couple months ago in our article about Seder's own conspiracy theories about inflation and the big corporate meanies. To refresh your memory, the quote goes like this:

"It will be important for corporations to continue to bring their markups back down after having raised them to unusually elevated levels over the past 2 years, which would help in reducing inflation. The markups associated with price-price spirals– with final goods prices going up by more than input prices – should unwind if customers become more price-sensitive and firms compete more intensely for customers."

As we mentioned last time (and as the caller

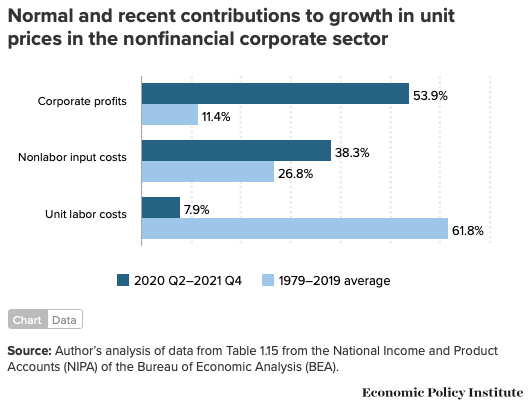

accurately mentions during the segment, using the exact same data from the left-leaning Economic Policy Institute that we did), what Lael Brainard said here is provably untrue. If corporations were conspiring to run up prices through "price-price spirals," as Brainard claimed in January of this year, then how are their own input prices going up as well? The answer(s) is (are), a) that isn't what's happening; the inflation we're seeing isn't caused by "corporate profits" and b) if it was, their own input prices wouldn't go up; they would stay the same, or perhaps even decrease. As you'll see in the chart below (which is taken directly from the EPI's study on the matter), the caller is indeed correct. Input costs for the "corporations" in question (and we still have no idea which corporations are in question here, or which ones were used in the study - we only know this data came from somewhere inside the non-financial corporate sector) did in fact increase 12 points on the dollar during the first six fiscal quarters of the pandemic, which does equate to about a 45% increase in unit production input costs.

But that's not all. As we mentioned in our last few articles on the topic, nowhere in this study does the EPI actually allege that these profit increases were from "price markups." In fact, the only time the word "markup" is ever even mentioned in the study at all, is when describing a profit markup - which as we've mentioned before, in previous articles - can be attained through dozens of different strategies. Profit markups can be created through spending cuts, contract renegotiations, vendor changes, selling stock buybacks, laying off workers, and a myriad of other ways. Thus, to claim that "marking up prices more than rising input costs" is what's causing our current bout of inflation is entirely unfounded, and much-less-so "price-gouging" (and again, we don't even have any idea whatsoever which "corporations" Vigeland or any other progressive is alleging is engaging in illegal price-gouging, and they probably don't either).

On a funnier note, after the caller shared this data with Vigeland and her cohosts, Majority Report resident-genius Matt Binder (who as we mentioned earlier, knows probably less about economics than anyone sitting in the room at the time), near the very end of the segment chimes in with his own sentiment using his complete lack-of-understanding of basic economics, claiming "if there was inflation, and they were forced to raise prices to keep up, there wouldn't be these record profits because their expenses would be up as well [...] but none of that's happening."

WHAT. THE. FUCK.

Matt Binder, if you're reading this right now, just 90 seconds before you said that, the caller read out to you verbatim, in layman's terms, the empirical data that proved that corporate expenses are up (from a left-wing biased source, we might add; but we do appreciate you shitting all over your own argument so we don't have to - but we will anyway because it's just too much fun). We're not sure if you just weren't listening, or if you have no idea what you're talking about (or some combination of the two), but either way, it makes you look awfully stupid, and that's putting it nicely, quite frankly. We don't mean to insult you, but the fact that you could come in with such a misguided, false statement after being provided empirical data to the contrary is utterly shocking. The voice-off-camera then chimes in with "Exactly!" presumably because he, like Matt Binder, has no idea what he's talking about.

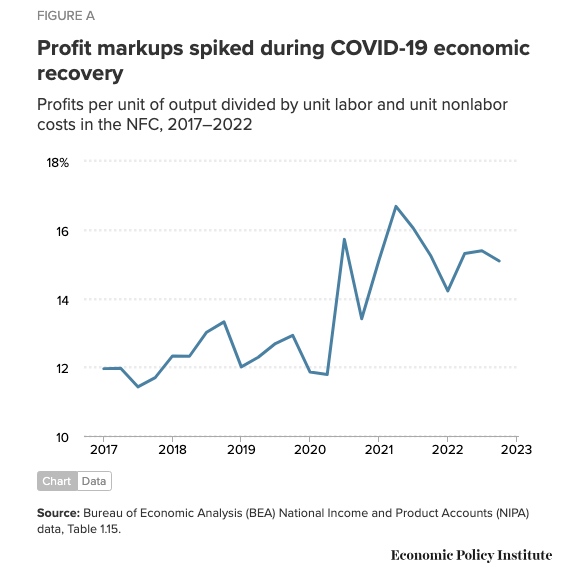

But back to the Axios article. The voice-off-camera reads yet another small passage, this one from a source even less credible than Lael Brainard (who also, unlike us, predicted we would see no inflation back in mid-2020 when all the Nobel laureate economists said words regarding inflation they now are being forced to eat). The source from this cited quote, Paul Donovan of UBS Wealth Management (which is based out of Switzerland, not the US), who doesn't live in the United States, but in Britain, and through our brief research seems to be of the Malthusian cult school of thought, citing the same sort of bullshit Thomas Robert Malthus blew out his asshole in the late 1700s. That said, based on the quote in question, it's not even clear he's talking about American companies - or even American inflation. Not to mention, he specifies in the quote he's talking about 2022, which again, according to our favorite left-leaning biased source, the Economic Policy Institute, the data shows that as inflation was on the rise and approaching its peak, corporate profits actually were dropping. You'll see that reflected in the graph depicted below, and you'll also see that these "corporate profits" really weren't that much higher than they were on average in the years leading up the pandemic, even at their highest peak in 2021, which was around 16%, profits were only about 3% higher than they were in the years leading up to the pandemic (and notice the graph title says "profit markups" and not "price markups" or "price-gouging", as Emma Vigeland and her cohosts wish it would say). But even if you use the margins bottoming-out around 12%, and round-up the peak to 17%, we're still only at a 5% difference, and only for the first year of inflation. Whereas, according to the CPI, not even 3 full years in above target inflation, we're 17% higher than we were 2 and a half years ago (and we hope it won't hit too much higher, but unfortunately, the CPI's inflation rate did start to accelerate again two months ago after a few months of deceleration; hopefully that won't continue).

On a side note, big thanks to the Economic Policy Institute for consistently proving our argument for us.

But back to resident-genius Matt Binder for a second, who also made quite a stupid argument in the middle of the segment, reading aloud a piece from the Los Angeles Times, anecdotally citing Tyson Foods, after the caller challenged the voice-off-camera, asking specifically for data, and not anecdotes, to show how much corporations were actually raising their prices. During Matt Binder's turn to talk - in between the adults talking - he stipulates that Tyson Foods raised their beef operating margins... gasp!... 5.9%! Then - and we kid you not - Matt Binder complained that Tyson Foods stopped losing money on their products, and turned their negative 7.6% profit margin into... dear God!... a positive 3.6% profit margin!!! Head for the hills!!! Run for your lives!!! Tyson Foods is making nearly four fucking percent profit on their products!!!!

---------------

Now that we've debunked virtually every single word said by the hosts during this segment, we'd actually like to mention that, at the very end of the call, before Emma Vigeland hung up on him without refuting what he said (and just as the call was getting really interesting, we might add), the caller actually offered Vigeland and her cohosts irrefutable proof that it is in fact the expansion of the money supply that caused the inflation. And unlike the conspiracy theories, anecdotes, and fundamental lack of understanding of basic economics from the cohosts at The Majority Report with Sam Seder, we can actually use empirical math to prove it.

Emma, if you're reading this, you're going to want to pay attention here. We're about to give you a 200-level Keynesian economics lesson. And we're going to lay this out for you in really simple, easy-to-understand terminology, and take you through the math step-by-step. This way, by the end of this article, you too will actually believe the truth - that expanding the money supply does in fact cause inflation.

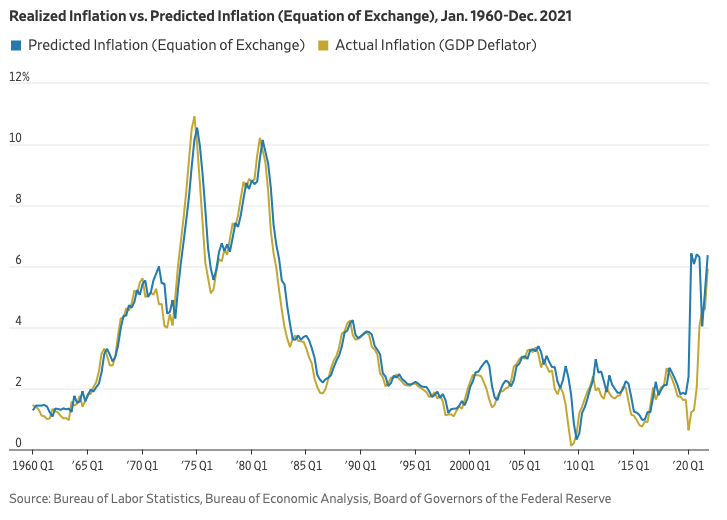

The caller accurately mentions at the end of the call that based on the equation of exchange, we know irrefutably that expanding the money supply will cause inflation in the economy. For Emma Vigeland, her cohosts, and anyone else that doesn't know what that is, it's actually quite simple. The equation of exchange, originally formulated by Irving Fisher of the Keynesian school of economic thought, accurately describes the relationship between money supply, velocity, GDP, and inflation through a simple mathematical formula. This formula has actually been used by the Federal Reserve for the last 60 years to accurately predict what the inflation rate will be (and so accurately, it's almost always within 1/10th of a point or so, we might add). How do we know this? Because the Fed, as well as the Bureau of Labor Statistics, and even the Bureau of Economic Analysis, all publish the same data year after year, using the same equation, using the same graph, which shows predicted inflation vs. actual inflation. And guess what... the predicted inflation lines and the actual inflation lines on the graph match up. Always.

The equation goes like this: M * V = P * y

If those letters don't make sense to you, don't worry; we're going to explain it to you right now.

M represents the money supply in a given economy. In America's case, the number we'll use for the money supply variable is going to be what the M2 says it is, as the M2 is more or less our best indicator of how many dollars is actually sitting in our economy at any given time. V is money velocity (and not the Maroon 5 album), and "velocity" in this case isn't a physics term - it's the number of times a federal reserve note changes hands in a given fiscal year. In other words, it can be thought of as how many transactions a federal reserve note is used in in a given year. P represents price level, or inflation, which is the variable we'll be solving for (keep in mind, this formula is a basic algebraic equation, so you can solve for more than one variable, given you have the other variables to use - more on this in a moment). And finally, y just represents the real GDP.

Good, simple so far. Now let's dig a little deeper. M will always be the easiest variable to figure out, because the M2 will give you the number. Velocity (V) and GDP (y) are also pretty easy to figure out, because they stay relatively constant. These numbers change at an extraordinarily slow rate, so we can use the current numbers we have right now to estimate what the inflation rate will be, and because they change so slowly, the estimate will still be pretty damn accurate.

Continuing, since we're solving for inflation (P), the exact version of the equation we'll use will look like this:

M * V / y = P

From there, it's as simple as plugging in the numbers. Below, we can see how accurate this equation actually is at predicting inflation.

See how perfectly they line up? In fact, the only time in the history of using this equation that the prediction was off, was right in March 2020 when the federal government locked down the economy. But, as soon as we were able to adjust the equation for the new GDP and velocity numbers (around Q3 2020), the predicted vs. actual inflation numbers locked up again.

Now Emma, if you've made it this far, sit down and think for a second, and ask yourself this question: how could this equation possibly work if the money supply didn't affect inflation? The answer is: it wouldn't. The fact that the equation of exchange is able to predict the inflation rate so accurately is because the money supply does in fact affect the inflation rate. That's true for the American economy. That's true for the Japanese economy. That's true for the Australian economy, and the Mexican economy, and the Chinese economy, and every single economy on the planet. Are you starting to understand?

So when you decided not to refute what the caller actually said, and just hung up on him, you missed an important lesson in economics you could have easily learned had you asked him to elaborate. And to be clear, it's not just us here at Ending Politics, or the caller to your show, or the Federal Reserve, or the Bureau of Labor Statistics, or the Bureau of Economic Analysis that knows this equation irrefutably proves that money supply affects inflation. It's also every other serious economist on the face of the earth. We're not the only ones that have written an article just like this, this year. In fact, many economists all over the United States have written more or less exactly what we've written above. This goes for John Hopkins University economists, to Oxford University economists, to even your run-of-the-mill finance bloggers.

And, since you love the federal reserve so much, if you don't take our word for it, or any of the economists' words for it whom we've linked here, then we'll also link you to this video to the St. Louis Fed's website, which will tell you the same thing, and they'll probably be able to explain it even better than we have.

Now Emma, we know that the fact that the equation of exchange works, and is therefore virtually irrefutable proof that expansions of the money supply do in fact cause inflation, probably sends your boss Sam Seder into a fit of rage. We can only imagine him seeing this data, then turning green, and ripping his shirt off like The Incredible Hulk, due also in part because his precious Modern Monetary Theory has been completely disproven through the sequence of monetary events and the following inflationary period over the past few years, and any remaining credibility MMT ever had being crumpled up and thrown right into the proverbial trash can. But just because your boss is an ideological zealot and a partisan hack that will never accept empirical, mathematical economic fact, doesn't mean you also have to be like that. By the way, this actually doesn't mean that we can't have medicare for all in this country, or some basic welfare programs, or social safety nets, or any of that shit that we know you love - it just means it'll take some serious, grounded economic planning to do so (as well as not voting for people who explicitly tell you they're not going to give you what you want such as medicare for all, like Joe Biden, for example - that's just never going to work, and we have not much sympathy for such levels of stupidity). But your cohosts on the other hand - we're sorry - but unlike you, they just might be too stupid to ever take the hint. That's definitely the case for Matt Binder.

Emma Vigeland, if you're still reading this, please understand that the evidence of what caused the inflation that has pinched the American people over the last few years is one-sided. Those of us (including us here at EndingPolitics.com) who predicted all this inflation right as the first round of stimulus was being passed by Congress in late March 2020, knew that not only would our country be hit with at least a brief inflationary period at best, and an economy-crippling period of inflation lasting several years at worst (if Congress kept passing large stimulus packages, which is exactly what they ended up doing), but we also knew when we made the prediction exactly why it would happen. If productive output doesn't grow fast enough to offset any additional expansion of monetary supply, rest-assured, you will see inflation. This is economic law, and has been since governments began issuing their own currencies, around the middle of the dominance of the Mesopotamian empire. And after all of us economics nerds accurately predicting the current inflationary period, and were told that we had no idea what we were talking about by people on your side of the political aisle was annoying enough as it was; but then after your progressive brethren were proven wrong six ways 'til next Sunday after our inflationary predictions came to fruition, and your progressive comrades then began claiming that even though we were right in our predictions, we were actually wrong about why it was happening, it became far more than just annoying - it became offensive. With all do respect, don't try to tell those of us who accurately predicted the current economic goings-on that we're wrong about any of this - it only makes the progressive community look more foolish, and also makes it all the more difficult to take the YouTube show you cohost seriously. And by the way, don't ever try to blame the rising prices on consumer goods we all have to deal with right now on "corporate profits" or Eastern European land disputes half a world away ever again - because it's quite clear that you have no fucking idea what you're talking about.

**drops mic**

FIN

-TF & Friends