David Sirota And Andrew Perez Don't Understand Inflation At All

You'd think two highly educated journalists would be able to figure this sort of thing out.

David Sirota is extremely confused on how inflation works, what causes it, and even what it actually is.

He published an article recently that proves just how ignorant he is on the subject, which was also parroted by Brie Joy Gray on The Hill's YouTube show Rising.

Sirota's "article" (which reads far more like an editorial than a well-researched article) was published in Jacobin Magazine (because apparently the writers over at Jacobin are experts in the field of economics now) and spends an upwards of forty paragraphs attempting to blame inflation on "corporate profits," which of course, anyone who's studied economics for more than five seconds knows that the profits a private company makes has absolutely no affect on inflation whatsoever.

On a side note, another problem David Sirota has is that he seems to think that inflation is just merely the rising of prices. This is incorrect. Inflation is simply the act of expanding an economy through printing money - quite literally making it bigger - which is unsurprisingly what the word inflation actually means. Consumer price inflation, on the other hand, is simply an aftereffect of inflating an economy. Sirota doesn't seem to know anything about economics whatsoever, which may explain his ignorance on the subject.

Anyhoo, those of us who actually predicted all the inflation we're seeing right now years in advance, during a time when everyone on Sirota's side of the political fence told us there would be no inflation post-pandemic and that we had no idea what we were talking about, will happily mansplain to David Sirota how all this actually works (and I say "mansplain" because he probably has similar testosterone levels to a woman).

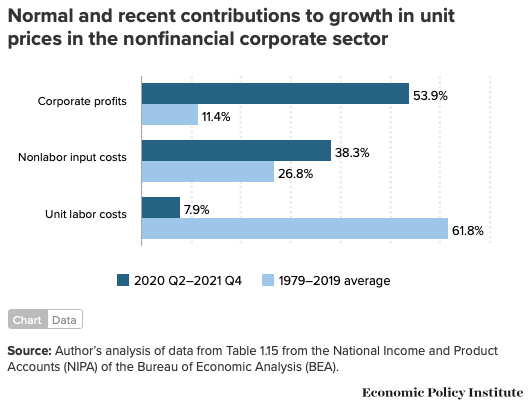

So right away, in only the second paragraph of Sirota's article, he cites a study done by the Economic Policy Institute which can be entirely debunked just by looking at the graph in their own article, in which the EPI itself admits that nonlabor input costs have increased for companies at an even higher rate than the CPI has hit year over year at the time of this writing. But don't just take our word for it! Please, look at the EPI's graph yourself, which we've taken the liberty of embedding below.

But of course, the dramatic increase of nonlabor input costs for companies isn't the only problem with the EPI's data here.

You'll also notice that the EPI, in order to get the data that they were looking for, had to average out their comparative data from 2019 all the way back to 1979, another pretty big problem when you consider they're comparing it only to 7 quarters in between 2020 and 2021, especially when it comes to unit labor costs, which with automation and computers, would and have obviously dramatically decreased naturally from all the way back in the late '70s.

But that's not all! We have yet another problem with this data, in the comparison between the "corporate profits" of seven fiscal quarters from Q2 2020 through Q4 2021 to one hundred and sixty fiscal quarters between 1979 and 2019. Most of our readers are pretty intelligent anyway, so we don't even need to begin to explain why that's an issue.

It would've been far more becoming of the Economic Policy Institute to compare the "corporate profits" of the few years (at most) leading up to 2020 if they really wanted to make a solid argument here - but we're guessing that data wouldn't have been as exciting to read for an individual with a David Sirota-level IQ.

But we're almost certain none of this ever caught David Sirota's attention at all - not that he would even know what to do with any of this data anyway - because he doesn't understand any of it, and probably didn't even read any of it to begin with. Our guess is he just saw the headline about "corporate profits" causing inflation on the EPI's website, and then ejaculated in his pants. We did reach out to David Sirota on Twitter to ask him what he thought about all this. He never responded. Imagine that!!!!

And yet we have another problem (there seems to be no end to the problem's with the EPI's study here): no where in the EPI's study do they correlate the price markups we've seen on consumer goods in the past couple years and "corporate profits" at all. But even if they had, we're not sure how or why the EPI would get to decide what a corporation's profits should be post-pandemic, in an era where their nonlabor input costs have increased even more than the CPI has per their own numbers. And while we're on the subject, a corporation has no idea how their market will react to price increases on their goods. Whenever you raise a price - be it warranted or not - you take a risk. There's no guarantee a consumer will continue to buy a product they've been paying a flat price for for a long time now that it's being sold at a higher price. What if they decide switch to a comparable and less expensive, off-brand product? What if they decide the value of the product just isn't worth the higher price? What if they just can't afford to buy it anymore? A corporation takes a big risk here, and they can either take an enormous loss if any of these things happen, or they can accordingly adjust their prices to mitigate some of the new risk involved, and make more money off the consumers that are still buying their product to offset some of their losses. This is of course something the Economic Policy Institute doesn't take into consideration at all (as you might've guessed).

David Sirota continues to try to blindside his readers by claiming that even the Wall Street Journal believes it! Even Rupert Murdoch says it's corporate greed! Gee!! I wonder why Wall Street and Rupert Murdoch would want the Fed to reverse course on its interest rate hikes!! What do you think, David Sirota!? Hmm.... 🤔

And then we come to the single biggest problem of all with the study Sirota cites: Corporations can increase profits in a myriad of different ways, not just price increases. Corporations can cut wasteful spending (something a bunch of highly-educated economists apparently don't understand at all) like in their marketing departments or positions they don't need. They can lay off secretaries or marketing directors. They can cut down on advertising. They can also cut maintenance costs on their company vehicles. They can cancel contracts with their business consultants. There are so many different ways a corporation can increase profits, there's no possible way we can list them all here. Any time a company doesn't spend operating income and instead pockets the difference (represented on the bottom line of the company's bank account), it's inherently increasing its profits. This is so obvious to anyone who knows anything at all about business that it's actually embarrassing (or at least it should be) for the economists over at the Economic Policy Institute to not account for in their study (which they don't at all, as far as we can tell). And especially in a situation where almost everyone who's been paying attention the last few years believes a terrible recession is looming, it shouldn't surprise anyone (especially a bunch of highly-educated economists) that companies are looking at their balance sheets and cutting unnecessary expenses, in an effort to get ready for tough times ahead.

On another note, Brie Joy Gray also gushed in her pants when she read Sirota's article, and brought one of Sirota's article's co-authors, one Andrew Perez, on The Hill TV's Rising to discuss the issue. Perez failed not in parroting all the talking points, but couldn't actually offer any real evidence whatsoever to prove that it's "corporate profits" that are driving inflation, besides the very vague claim that, well, profits are going up, and inflation is rising, so it must be increasing corporate profits causing inflation!!!!

Hilariously, early on in the segment, Perez actually makes the claim that EPI's study showed that "corporate profits were making up a disproportionate share of the price hikes" consumers have been seeing, which as we've already proven, is actually not what the study shows at all.

Throughout the segment, Perez continues to hammer home his point without any evidence to prove it, that "corporate profits are causing the inflation" we're experiencing in the economy right now, never once actually detailing why or how, or explains how "corporate profits" have any affect on inflation whatsoever (our guess is the reason why he never elaborates on this is because he actually has no idea what he's talking about).

And interestingly enough, while throwing him what she thought were softball questions, Brie Joy Gray actually asked Perez the $64,000 question: "Andrew, what kind of evidence do you think, you know, voters - consumers are pointing to to kind of come to this realization, despite the fact that as you've mentioned, these mainstream outlets have not really been reporting this out until recently."

And this was the moment that this moron exposed just how ignorant he was on the subject. He claimed that voters just "instinctively kind of understand" that corporations are ripping them off just because the things they're buying at the store are "more expensive."

What. The. Fuck.

This moron, without any evidence, claimed that voters (a large minority of them, only 35%; according to a poll from the Morning Consult), just know that they're being ripped off, because the things that they're buying are... more expensive. I have to wonder how stupid the "35% of voters" this Morning Consult poll is citing, and whether or not its more or less so than David Sirota and Andrew Perez.

This Rising segment is so ridiculous and laughable that it would be wrong of us to not embed it at the bottom of this article for your viewing entertainment. Notice in the thumbnail the smug look on Brie Joy Gray's face, as if she's smarter and knows far more about economics than you do.